In the wake of the Federal Trade Commission establishing a new international pharmaceutical merger working group, deal parties need to be prepared for a longer merger review process with a potential focus on a wider array of issues and heightened scrutiny of divestiture buyers, attorneys said.

However, the attorneys said it remains unclear whether and how the group will ultimately impact the outcomes of antitrust reviews or affect dealmaking in the sector, given the lack of any corresponding change to legal standards and the bipartisan split of the commission.

On 16 March, the FTC announced the formation of a global, multilateral working group that aims to retool how pharmaceutical mergers are evaluated to ensure the full spectrum of competitive effects are considered. The group also includes European, British, and Canadian regulators, as well as the US Department of Justice and Offices of State Attorneys General.

The announcement, which signals a tough stance on deal-savvy pharma giants, immediately hit stock prices of biopharma companies, according to media reports. The joint project comes amid an evolving political climate that has put big tech and pharma in the crosshairs, and the start of Rebecca Kelly Slaughter’s tenure as acting FTC chair. Slaughter has repeatedly voiced concerns about consolidation in healthcare.

Longer review timelines expected

This environment of heightened scrutiny could result in longer merger investigations, which could see member agencies of the working group delve into a wider array of topics to explore novel theories of competitive harm, according to Maureen Ohlhausen, a partner at Baker Botts and head of the firm’s global antitrust practice. Ohlhausen previously served as a commissioner and acting chair of the FTC.

She suggested that dealmakers should be prepared for potentially extended review timelines and for agencies to expand the scope of their questions during reviews.

Ted Hassi, an antitrust partner at Debevoise & Plimpton, agreed, adding that prolonged reviews could be particularly relevant for cross-border transactions, which would involve coordination among competition agencies around the globe.

“Just getting everybody on the same page is going to take additional time, and probably additional processes,” Hassi said.

Even before the formation of the group, Slaughter has pushed for large pharmaceutical deals to be assessed through a broader lens, rejecting the FTC’s typical approach to transactions in this sector of simply evaluating overlaps involving marketed and pipeline drugs.

“That means, if a deal involves a biotech target that is developing a product with a similar indication to one that is already in the buyer’s portfolio, or if the buyer has a perceived strength in a particular therapeutic area that matched up with the biotech target, that could make it a longer look under the review,” Hassi said.

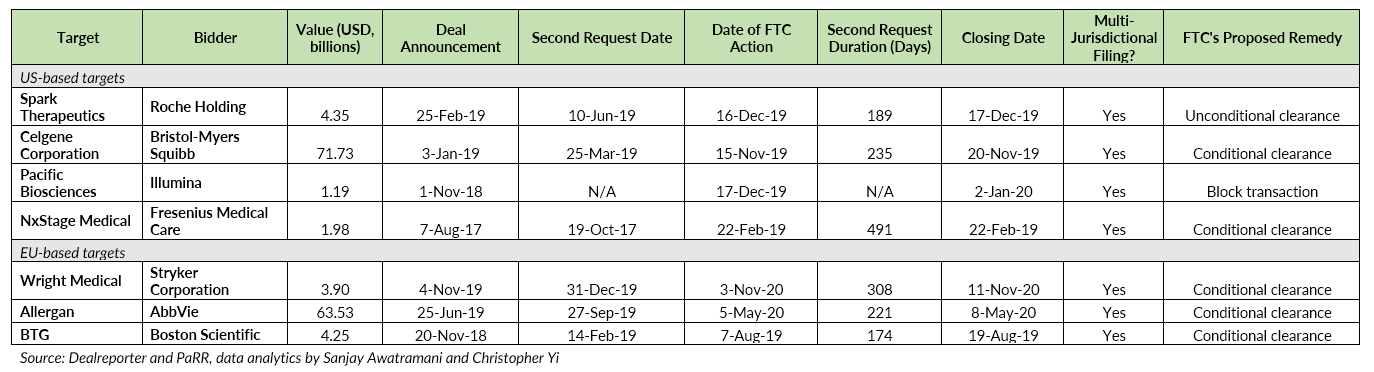

According to Dealreporter and PaRR data, among the 62 public healthcare transactions in North America that have been announced since 2017, at least four went through lengthy FTC reviews exceeding six months.

During the same period, 39 deals in the sector with European targets were announced, including three that also cleared FTC review following a second request. The average second request duration of these situations is 270 days.

Selected healthcare transactions experienced lengthy FTC second request:

Divestiture buyers under the microscope

The FTC might also become more “persnickety” about whom merging parties select as divesture buyers and push for broader remedies, Ohlhausen said.

Dealmakers need to consider these factors when running a divestiture process, according to Debevoise M&A partner Andrew Bab. Divestiture buyer choice has already been a focus for Democratic commissioners, he said. “They are keen to make sure that the buyer is going to be able to continue to compete and has an incentive to do so.”

Bab and the Debevoise team advised Allergan in connection with the divesture of two assets to address antitrust concerns stemming from its USD 63bn sale to AbbVie [NYSE:ABBV]. Among those, the parties returned the rights of brazikumab, an experimental digestive disease drug, to AstraZeneca [NYSE:AZN], which originally developed the product.

Ohlhausen expects that the closer degree of scrutiny being applied by the FTC to the pharmaceutical sector could spill over into deals involving firms in other healthcare areas, including diagnostics and medical devices.

“I think everything now is under the microscope. You’ve got all of this happening against the background of Congress considering different rules for antitrust laws, changing merger presumptions, and putting restrictions in place on companies with large market capitalization,” she explained.

Healthcare is particularly important for consumers and is a large part of national spending, so it makes sense for the antitrust agency to spend a lot of its resources there, she added.

In late March, the FTC voted unanimously to challenge Illumina’s [NASDAQ:ILMN] proposed USD 7.1bn acquisition of Grail over vertical concerns. Ohlhausen said this tracks with the FTC’s focus on protecting nascent competition and preventing vertical foreclosure.

Impact on dealmaking

It remains to be seen what concrete changes the working group initiative will produce and how it will ultimately impact dealmakers’ M&A strategies, all attorneys said.

This news service last week reported that the FTC’s ongoing review of Alexion’s [NASDAQ:ALXN] sale to AstraZeneca may serve as a bellwether.

However, these attorneys noted that any merger challenges by the FTC or DOJ are subject to review by the courts – which generally have a “more pragmatic” understanding of antitrust issues as interpreted by case law, Ohlhausen said.

The judiciary tends to be reticent to accept theories of competitive harm that fall outside existing precedent, so enforcers will likely have a difficult time bringing such cases, Ohlhausen said.

The agency will also need to balance its decision-making by considering the potential consequences of enforcement, the substantial cost of litigation, and the allocation of finite resources, she continued.

Hassi said the agency must be careful about how far it wants to push with any given divestiture fix, as companies might opt to litigate, and the courts “might not necessarily share the agency’s view on the merger’s potential effects.”

Meanwhile, the 2-2 split at the commission will be a limit on Slaughter’s ability to force things through, Ohlhausen said. This dynamic could “very much play in the merging parties’ favor,” as the acting chair needs at least one Republican commissioner to vote to block a deal or reach a consent agreement with merging parties – at least until a new Democratic commissioner is confirmed to fill the vacancy, Ohlhausen noted.

Despite potential regulatory headwinds, Bab still expects robust healthcare deal activity moving forward, since big pharmaceutical companies are losing patent protection and constantly on the hunt for assets to fill up pipelines and scale, while emerging biotech firms would like to sell to market leaders with the capability to accelerate clinical development and commercialization.

“The value chain generally seems to work,” he said.

by Yiqin Shen in New York and Christopher Kane in Washington DC